Federal Gasoline Excise Tax Rate

Sep 13, 2022 By Triston Martin

A federal gasoline excise tax levy was established in the United States to raise revenue for various transportation-related initiatives that needed funding. The Revenue Act of 1932 was first implemented at a rate of $0.01 per gallon, bringing in a total of $125,000,000 during its first year of operation. The price per gallon has increased incrementally over the last years, now $0.184. On June 22, 2022, President Biden made a plea to Congress to suspend the collection of government revenue from the gas tax for three months, until September 30, 2022.

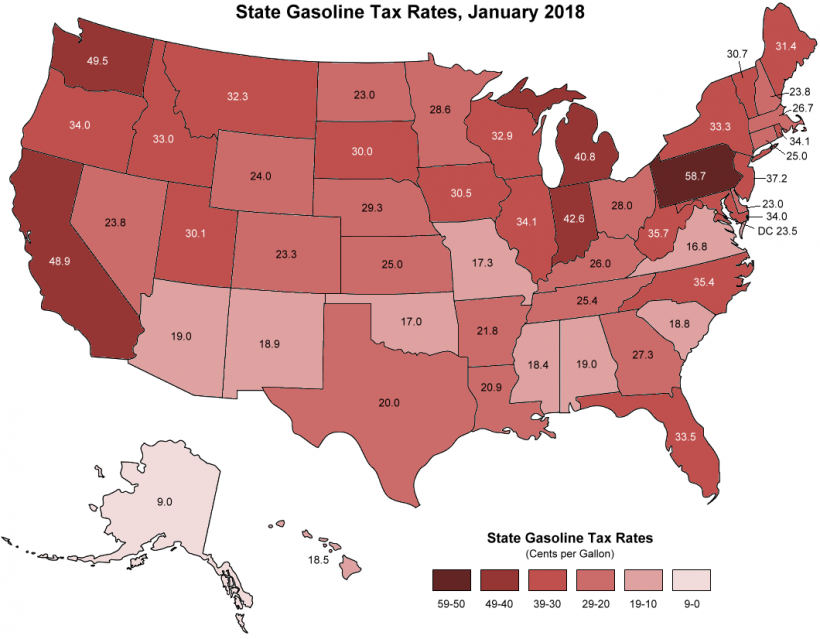

An excise tax is a sort of tax placed on the sale of certain items, such as gasoline; the federal gas tax is an example of this type of tax. Because they are included in the price at which the product may be acquired, these taxes are ultimately borne by the end user. Consumers in every state in the United States pay the same federal gas excise tax rate when they purchase a gallon of gasoline. However, the total amount that they pay for that gallon of gasoline is determined by the rules of the state and the area in which they purchase their fuel. For example, whereas drivers in Mississippi pay a total of $0.20 per gallon of petrol in federal and state taxes, drivers in California pay a staggering $0.67 for the same gallon of gas. This disparity is because California has a higher per-gallon tax rate.

Federal Gasoline Excise Tax Working

The Highway Trust Fund is used to pay for infrastructure and transportation expenditures, and this policy has been a source of conflict among many different parties over the years. The Highway Trust Fund receives money from federal gas taxes. According to the American Society of Civil Engineers' Report Card for America's Infrastructure, forty percent of the country's highways are rated as "poor" or "mediocre" condition. Several authorities believe that increasing the gas excise tax might assist in funding upgrades.

The federal excise tax on gasoline is a mix of two different levies. It includes a leaky underground storage tank (LUST) price of $0.001 per gallon, which is applied to the tax-per-gallon rate on gasoline and diesel fuel. This fee applies to states that have LUSTs. The money from the LUST charge is put into a trust fund established in 1986. Its purpose is to prevent petroleum spills from underground storage tanks that the federal government controls. Additionally, it provides funding for the supervision and enforcement of the remediation of petroleum leaks. It finances the inspections and the clean-up costs in the event the person responsible cannot be identified.

The price you pay at the pump may vary significantly depending on where you live and how much petrol is sold in your state due to the federal gasoline excise tax already in place and the fuel tax that is levied by each state. Currently, the federal excise duty rate on a gallon of gasoline is $0.184. Since 1933, there have been ten separate increases in the rate, but there hasn't been another since 1997.

Example

A snapshot of the five states with the highest petrol costs for normal unleaded gasoline as of March 2022, according to the American Automobile Association, is provided as an illustration of how gas prices might vary from state to state as follows:

- $5.73 per gallon in the state of California

- Hawaii: $4.935 per gallon

- Nevada: $4.932 per gallon

- Oregon: $4.735 per gallon

- 4.73 dollars thirty cents per gallon in Washington

State Taxes on Gasoline

Every gallon of gasoline purchased in a state is subject to federal and state taxation in addition to the federal tax. According to research published by the American Petroleum Institute in January 2022, the following states had the highest levels of state gas taxes:

- California: $0.6815 per gallon

- Pennsylvania: $0.5870 per gallon

- Illinois: $0.5960 per gallon

- 0.5070 dollars per gallon in the state of New Jersey

Alternatives

Suppose the price of petrol is wreaking havoc on your monthly budget, whether due to a lengthy commute or a profession requiring frequent travel. It would help if you thought about ways to save money on gasoline by utilizing public transit or combining excursions. Carpooling with coworkers is not only a fantastic method to save money but also will save you the stress of dealing with rush hour traffic. You may save money on petrol by utilizing applications that assist you in locating the stations that sell it at the lowest price in a certain location. When you use some companies' applications, you can even earn loyalty points or other advantages as a reward from those companies.

Jul 04, 2023 Susan Kelly

Nov 26, 2022 Triston Martin

Oct 24, 2022 Triston Martin

Aug 09, 2022 Susan Kelly

Jun 06, 2023 Susan Kelly

Aug 14, 2022 Triston Martin